See listing of Recent and Most Popular articles on the Home Page

Senior Moments

Category: Retirement / Topics: Hopes & Dreams • Planning • Retirement

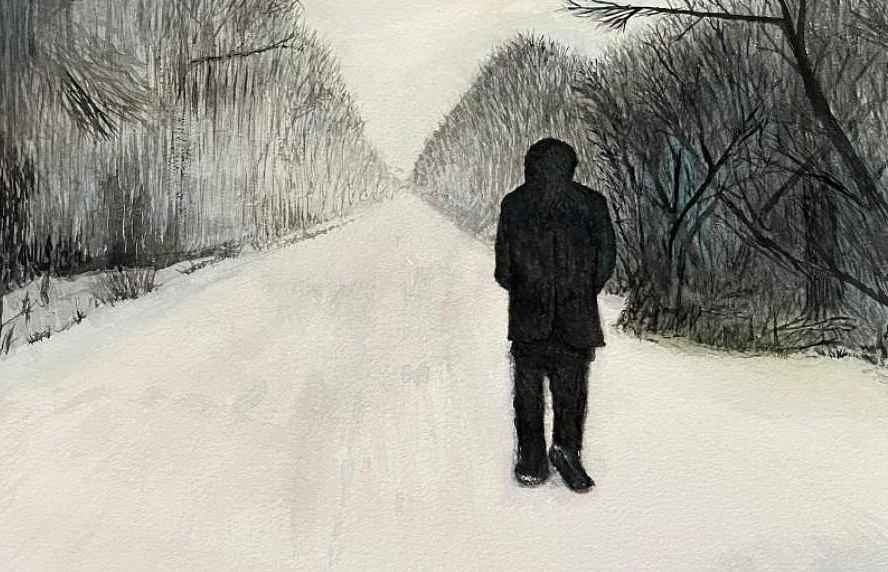

A Cozy Retirement

by Dan Seagren

Posted: June 18, 2017

Getting there requires an early start…

As a fading senior (retired for 21 years) my computer in minutes prompted me to write about planning ahead. The reasons are legion but in reality, other matters seem more important than building a nest egg for retirement. Here is some of what came up in one short series of related articles.

Nearly one-half of Americans live paycheck to paycheck. Every licensed driver in the U.S. on average owes about $6,100 in car payments. Only ten percent of workers over age 22 have a traditional pension today. Merely a third of workers are saving in a 401(k) or similar tax-deferred retirement plan. Only 14 percent of employers offer plans, mostly by large companies.

The number of millionaire households in the United States has grown by more than 800,000 over the past five years. The lower 70% of the population holds just 9% of the liquid wealth available in America. Student debt and auto loans are at record levels. Consumer debt is rising at the fastest pace in three years. Many potential retirees have more important things to do than save for the future. When I was a child, retirement wasn't even in the vocabulary.

This is merely a sampling but serves as a warning, does it not? Retirement costs are rising, and most likely will do so in the future. Refusing a 401k or similar retirement plans, plus fewer and fewer pensions offered, minuscule savings and growing debts, retirement may not be as cozy as anticipated. Why this is happening involves many factors including youth and middle-aged prospects who say they have better things to do than save for tomorrow.

One proposal caught my attention. “Right now, the human worker who does, say, $50,000 worth of work in a factory, that income is taxed . . . If a robot comes in to do the same thing, you’d think that we’d tax the robot at a similar level . . .” Would employers go for that? Unemployment and underemployment might be benefited if employers would agree. Reliance on Uncle Sam or a wealthy Aunt Anna might help. Parents setting a good example would help and having children to help out when retirement looms is diminishing.

In light of the workplace today where saving for the future is fading, a prospect for a cozy retirement is to get rich now or lay aside for tomorrow. When I was in my mid career, Certificates of Deposit (CDs) were pushing 18% and retirees were comfortable with them but not fully aware of their future (today under 1%). So save (invest) for tomorrow but do so wisely. OK?

Search all articles by Dan Seagren

Dan Seagren is an active retiree whose writings reflect his life as a Pastor, author of several books, and service as a Chaplain in a Covenant Retirement Community. • E-mail the author (su.nergaesnad@brabnad*) • Author's website (personal or primary**)* For web-based email, you may need to copy and paste the address yourself.

** opens in a new tab or window. Close it to return here.

Posted: June 18, 2017 Accessed 607 times

![]() Go to the list of most recent Senior Moments Articles

Go to the list of most recent Senior Moments Articles

![]() Search Senior Moments (You can expand the search to the entire site)

Search Senior Moments (You can expand the search to the entire site)

![]() Go to the list of Most Recent and Most Popular Articles across the site (Home Page)

Go to the list of Most Recent and Most Popular Articles across the site (Home Page)

Loading requested view...

Loading requested view...