See listing of Recent and Most Popular articles on the Home Page

Senior Moments

Category: Retirement / Topics: Financial • Planning • Retirement • Trends

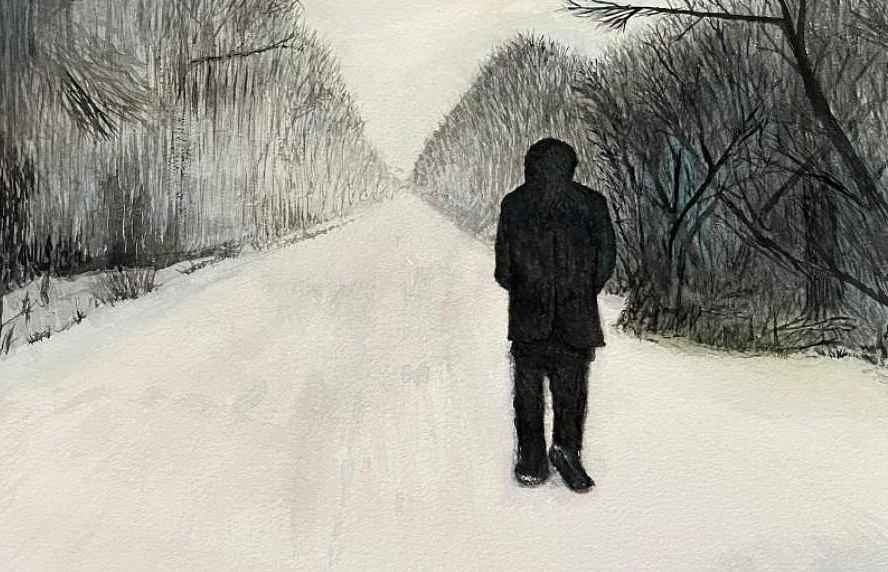

Retirement Ahead

by Dan Seagren

Posted: October 16, 2016

A few thoughts for those approaching retirement…

Retirement as we know it was unknown until quite recently when looking at the long history of civilization. Today we have Social Security, Pensions, IRAs, 403b and 401k plans, savings, investments, equities in our home, appreciation and the like. Much of this did not exist years ago.

Here are a few thoughts for seniors who are prospects for retirement and after thoughts for those already retired; but food for thought for youngsters (maybe 21-50?).

Much has changed in the last few decades. Inflation makes the dollar look good but looks can be deceiving. A pretty good house or vehicle might cost $10,000 and $1,000 respectively years ago but perhaps $200,000+ and $20,000+ today. Is the dollar worth that much more today? A study of fifty cities said average house prices now range from about $100,000 to more than $800,000!

Every $100,000 now at age 65 creates about $5,900.00 annuity income. Making things more difficult, people today are saving less for retirement than in years past and interest rates are at historic lows. Twenty-five years ago a 10-year Treasury yield was about 8% versus about 1.5% today. Ordinary savings around 0.05% now. Ouch.

Life expectancy according to one study has increased about 1.6 years per decade for the last few years and as I write, I am 10 years older than when my father died at 78 in 1973. He retired at 66, I was 68. Today many more are working longer, part time and full time, some in their regular job; others elsewhere. Many wives have worked part or full time lately presumably adding to retirement income, though our high divorce rate often complicates matters.

Families have grown smaller, adding to retirement equations. Changes in family size and the mobility of people today makes it difficult to compare retirement years ago with today. For example, my father was one of ten children; my family included five siblings, and our daughter has two children. When I was about four years old and my mother had died, my sister and I went with our surrogate mother (our father's sister) to their farm home for several summers. Living there was my grandmother and her two single sons. Seven of their siblings had moved on. Then my grandmother and an uncle exited the farm. My other uncle and his wife left and his wife's brother took over. An indication of the evolution of families that has had a radical impact on care for our elders and the whole concept of retirement.

The study I referred to earlier had this admonition for today and is well worth repeating:

1) Start saving early 2) Save more 3) Work a little longer.

Search all articles by Dan Seagren

Dan Seagren is an active retiree whose writings reflect his life as a Pastor, author of several books, and service as a Chaplain in a Covenant Retirement Community. • E-mail the author (su.nergaesnad@brabnad*) • Author's website (personal or primary**)* For web-based email, you may need to copy and paste the address yourself.

** opens in a new tab or window. Close it to return here.

Posted: October 16, 2016 Accessed 380 times

![]() Go to the list of most recent Senior Moments Articles

Go to the list of most recent Senior Moments Articles

![]() Search Senior Moments (You can expand the search to the entire site)

Search Senior Moments (You can expand the search to the entire site)

![]() Go to the list of Most Recent and Most Popular Articles across the site (Home Page)

Go to the list of Most Recent and Most Popular Articles across the site (Home Page)

Loading requested view...

Loading requested view...