See listing of Recent and Most Popular articles on the Home Page

Finance and Legal

Category: Health & Wellness / Topics: Disease • Financial • Health Care • Social Issues • Statistics • Trends

Sick and Struggling to Pay

Posted: June 25, 2022

100 millioin people in the U.S. live with medical debt…

Editor's Note: While health issues become more dominant for most of us as we grow older, health issues and the debt that can accumulate are problems for a huge proportion of Americans across age chohorts. Following is an excerpt of a much longer artciel posted on June 16 by Noam Levey of NPR, who reports on a collaborative research with Kaiser Health News and others (see the notes at the end of full article). Here, we present the emajor sections of the report with the opening paragraphs from each. Follow the link at the bootom of the page to access the full article, with powerful persoanl examples, photos, charts, and links to related resources.

Elizabeth Woodruff drained her retirement account and took on three jobs after she and her husband were sued for nearly $10,000 by the New York hospital where his infected leg was amputated.

Ariane Buck, a young father in Arizona who sells health insurance, couldn't make an appointment with his doctor for a dangerous intestinal infection because the office said he had outstanding bills.

Allyson Ward and her husband loaded up credit cards, borrowed from relatives, and delayed repaying student loans after the premature birth of their twins left them with $80,000 in debt. Ward, a nurse practitioner, took on extra nursing shifts, working days and nights.

"I wanted to be a mom," she said. "But we had to have the money."

The three are among more than 100 million people in America ? including 41% of adults ? beset by a health care system that is systematically pushing patients into debt on a mass scale, an investigation by KHN and NPR shows.

The investigation reveals a problem that, despite new attention from the White House and Congress, is far more pervasive than previously reported. That is because much of the debt that patients accrue is hidden as credit card balances, loans from family, or payment plans to hospitals and other medical providers.

To calculate the true extent and burden of this debt, the KHN-NPR investigation draws on a nationwide pollconducted by KFF (Kaiser Family Foundation) for this project. The poll was designed to capture not just bills patients couldn't afford, but other borrowing used to pay for health care as well. New analyses of credit bureau, hospital billing, and credit card data by the Urban Institute and other research partners also inform the project. And KHN and NPR reporters conducted hundreds of interviews with patients, physicians, health industry leaders, consumer advocates, and researchers.

The picture is bleak.

In the past five years, more than half of U.S. adults report they've gone into debt because of medical or dental bills, the KFF poll found.

A quarter of adults with health care debt owe more than $5,000. And about 1 in 5 with any amount of debt said they don't expect to ever pay it off.

"Debt is no longer just a bug in our system. It is one of the main products," said Dr. Rishi Manchanda, who has worked with low-income patients in California for more than a decade and served on the board of the nonprofit RIP Medical Debt. "We have a health care system almost perfectly designed to create debt."

The burden is forcing families to cut spending on food and other essentials. Millions are being driven from their homes or into bankruptcy, the poll found.

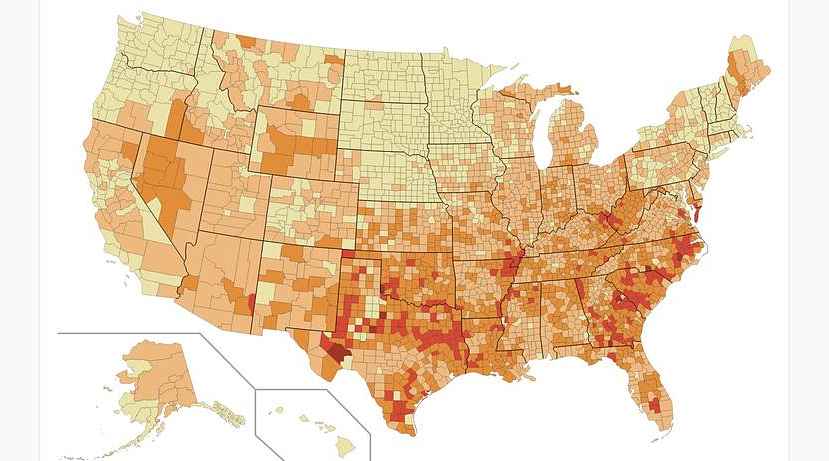

Medical debt is piling additional hardships on people with cancer and other chronic illnesses. Debt levels in U.S. counties with the highest rates of disease can be three or four times what they are in the healthiest counties, according to an Urban Institute analysis.

The debt is also deepening racial disparities.

And it is preventing Americans from saving for retirement, investing in their children's educations, or laying the traditional building blocks for a secure future, such as borrowing for college or buying a home. Debt from health care is nearly twice as common for adults under 30 as for those 65 and older, the KFF poll found.

Perhaps most perversely, medical debt is blocking patients from care.

About 1 in 7 people with debt said they've been denied access to a hospital, doctor, or other provider because of unpaid bills, according to the poll. An even greater share ? about two-thirds ? have put off care they or a family member need because of cost.

"It's barbaric," said Dr. Miriam Atkins, a Georgia oncologist who, like many physicians, said she's had patients give up treatment for fear of debt.

In debt to hospitals, credit cards, and relatives

America's debt crisis is driven by a simple reality: Half of U.S. adults don't have the cash to cover an unexpected $500 health care bill, according to the KFF poll.

As a result, many simply don't pay. The flood of unpaid bills has made medical debt the most common form of debt on consumer credit records.

As of last year, 58% of debts recorded in collections were for a medical bill, according to the Consumer Financial Protection Bureau. That's nearly four times as many debts attributable to telecom bills, the next most common form of debt on credit records. . . .

Bearing the burden of debts large and small

For many Americans, debt from medical or dental care may be relatively low. About a third owe less than $1,000, the KFF poll found.

Even small debts can take a toll. . . .

Health care debt can also be catastrophic. . . .

About 1 in 8 medically indebted Americans owe $10,000 or more, according to the KFF poll.

Although most expect to repay their debt, 23% said it will take at least three years; 18% said they don't expect to ever pay it off.

Medical debt's wide reach

Debt has long lurked in the shadows of American health care.

In the 19th century, male patients at New York's Bellevue Hospital had to ferry passengers on the East River and new mothers had to scrub floors to pay their debts, according to a history of American hospitals by Charles Rosenberg.

The arrangements were mostly informal, however. More often, physicians simply wrote off bills patients couldn't afford, historian Jonathan Engel said. "There was no notion of being in medical arrears."

Today debt from medical and dental bills touches nearly every corner of American society, burdening even those with insurance coverage through work or government programs such as Medicare.

Nearly half of Americans in households making more than $90,000 a year have incurred health care debt in the past five years, the KFF poll found. . . .

The strongest predictor of medical debt

Desiree Dantona said the debt has also made her sister hesitant to seek care to ensure her cancer remains in remission.

Medical providers say this is one of the most pernicious effects of America's debt crisis, keeping the sick away from care and piling toxic stress on patients when they are most vulnerable.

The financial strain can slow patients' recovery and even increase their chances of death, cancer researchers have found.

Yet the link between sickness and debt is a defining feature of American health care, according to the Urban Institute, which analyzed credit records and other demographic data on poverty, race, and health status.

U.S. counties with the highest share of residents with multiple chronic conditions, such as diabetes and heart disease, also tend to have the most medical debt. That makes illness a stronger predictor of medical debt than either poverty or insurance. , , ,

What the federal government can do

The Affordable Care Act bolstered financial protections for millions of Americans, not only increasing health coverage but also setting insurance standards that were supposed to limit how much patients must pay out of their own pockets.

By some measures, the law worked, research shows. In California, there was an 11% decline in the monthly use of payday loans after the state expanded coverage through the law.

But the law's caps on out-of-pocket costs have proven too high for most Americans. Federal regulations allow out-of-pocket maximums on individual plans up to $8,700.

Additionally, the law did not stop the growth of high-deductible plans, which have become standard over the past decade. That has forced growing numbers of Americans to pay thousands of dollars out of their own pockets before their coverage kicks in.

Last year the average annual deductible for a single worker with job-based coverage topped $1,400, almost four times what it was in 2006, according to an annual employer survey by KFF. Family deductibles can top $10,000.

While health plans are requiring patients to pay more, hospitals, drugmakers, and other medical providers are raising prices.

From 2012 to 2016, prices for medical care surged 16%, almost four times the rate of overall inflation, a report by the nonprofit Health Care Cost Institute found.

For many Americans, the combination of high prices and high out-of-pocket costs almost inevitably means debt. The KFF poll found that 6 in 10 working-age adults with coverage have gone into debt getting care in the past five years, a rate only slightly lower than the uninsured.

Even Medicare coverage can leave patients on the hook for thousands of dollars in charges for drugs and treatment, studies show. . . .

Search all articles by Naom Levey

Posted: June 25, 2022 Accessed 795 times

![]() Go to the list of most recent Finance and Legal Articles

Go to the list of most recent Finance and Legal Articles

![]() Search Finance and Legal (You can expand the search to the entire site)

Search Finance and Legal (You can expand the search to the entire site)

![]() Go to the list of Most Recent and Most Popular Articles across the site (Home Page)

Go to the list of Most Recent and Most Popular Articles across the site (Home Page)

Loading requested view...

Loading requested view...