See listing of Recent and Most Popular articles on the Home Page

Health & Wellness

Category: News & Current Events / Topics: COVID-19 • Crisis • Dying and Death • Disease • History • News • Statistics • Trends

COVID-19 Perspectives for August 2021

by Stu Johnson

Posted: September 8, 2021

After nearly seven months of 'flattening the curve' for USA, the delta variant has made its presence known here and around the world, with tightened restrictions…

Putting the COVID-19 pandemic numbers in perspective (Number 14)

See a list of all of my articles related to COVID-19

This series was spawned by my reaction to reporting early in the COVID-19 pandemic that focused on raw numbers. Big numbers are impressive, even frightening, but hard to comprehend. This series turned into a monthly summary setting the U.S. numbers in global perspective. This analysis is based on data from worldometers.info, which monitors 215 countries. From those, I focus on details for 27 countries since I started more detailed tracking in September 2020. (Philippines was added to the list this month because it has appeared in the weekly report of most new activity and is now in the top-20 of cases and deaths).

A note on reliability of data: It should be noted that the statistics reported by worldometers and other sources are only as good as the integrity of the reporting system in each country. China's statistics have increased so little since I started tracking numbers that it is doubtful its numbers are accurate, so they are not included in charts that focus on countries. Other countries have also had gaps in reporting, or made adjustments. Still, there is enough information to make trends evident. That is why I tend to round some numbers and watch for changes over two or three months rather than focusing on a single month, as significant as that may turn out to be.

These reports will continue as long as the pandemic persists around the world.

Report Sections:

• August at-a-glance

• The Continental View • USA Compared Other Countries

• COVID Deaths Compared to the Leading Causes of Death in the U.S.

• U.S. COVID Cases versus Vaccinations

• Profile of Monitored Continents & Countries • Scope of This Report

August-at-a-glance

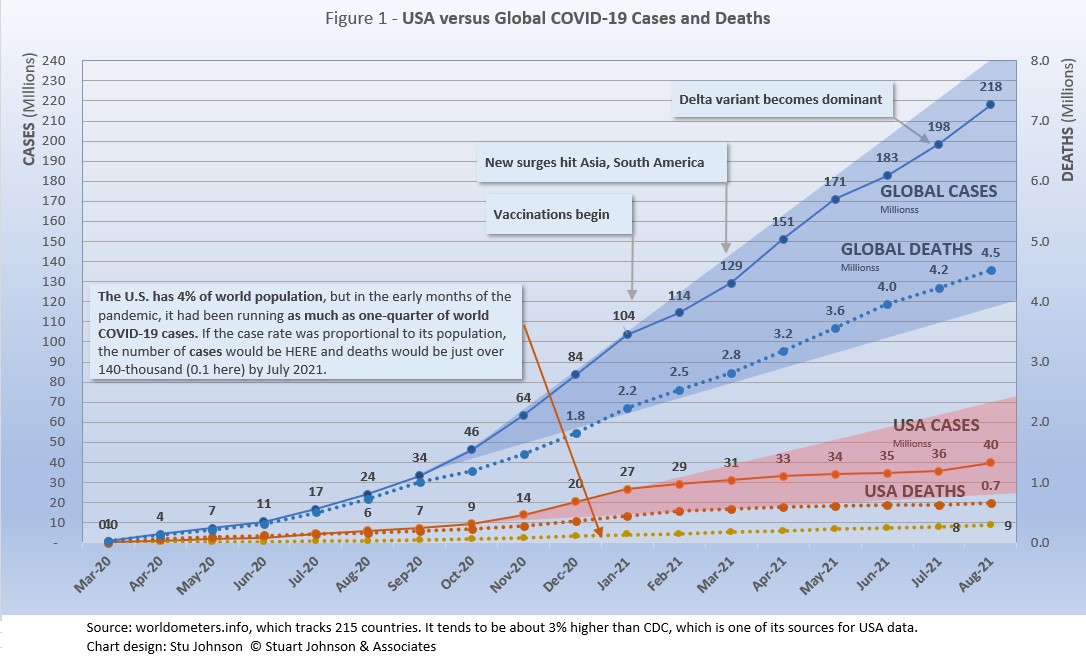

- COVID-19 continued to spread around the world, reaching 218-million cases by the end of August, up 10% from July, following a bump to 9% in June after slowing to 7% in May. There is no doubt that the bump observed last month has definitely become a surge in some places, attributable to the now-infamous "delta" variant of the virus.

The level of reported cases represents 2.8% of the global population of 7.8-billion, up from 2.5% at the end of July, the largest month-to-month increase since May.

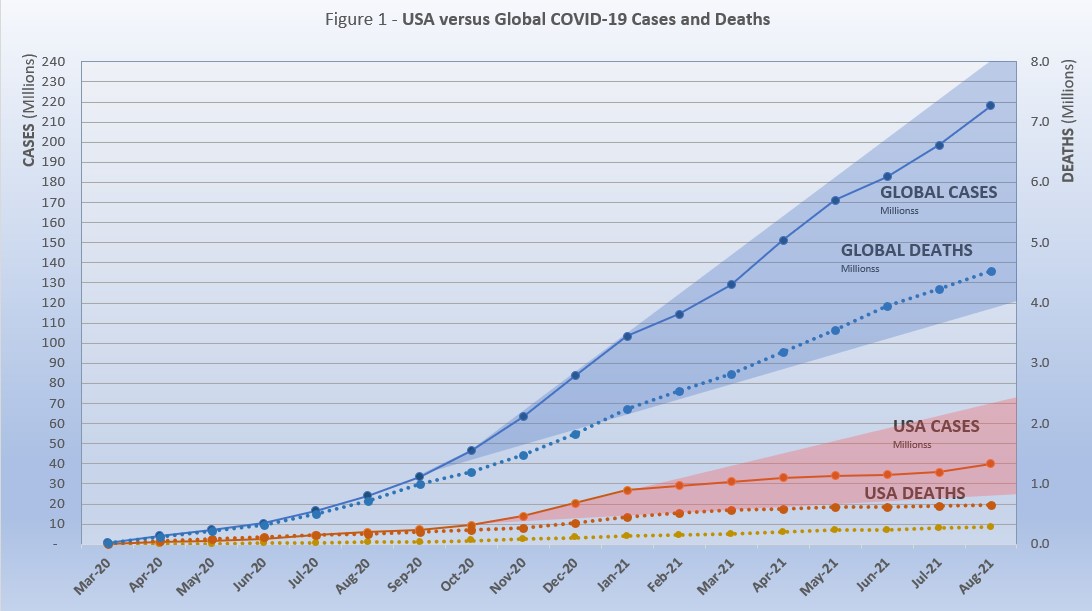

The blue "cone" in Figure 1 shows the possible high and low projection of global cases, with the bottom (roughly 115-million) representing the trajectory of the lower pace in late summer 2020 and the upper (approximately 240-million) representing a continuation of the surge from November 2020 through January 2021. You can see that the curve for global cases has bent down and back up several times since February 2021, but is slowly moving away from, but still close to, the upper edge of the prediction cone. USA has fared better until August, which I'll get to below. - The pattern for deaths tends to lag behind cases by several weeks, and the global rate of increase continues to fall below that of cases—dropping from a 23% increase in January to 7% at the end of July and August. While the curve for deaths is not increasing as much as that for cases, it is still climbing at a noticeable rate (unlike USA where cases and deaths flattened between January and July).

- A significant difference that is emerging is the comparison, by continent and country, between the curves over time for cases compared to deaths. Two striking examples: while cases in USA have taken a decided turn upward as a result of the delta variant of COVID, the death rate remains relatively flat. On the other hand, South America as a continent and some of tis constituent countries, has slowed in the number of cases while death rates continue to climb. We must recognize, of course, that the death timeline trails cases by weeks or even months, so these are trends that may unfold further in months to come.

- USA. continues to lead the world in the number of reported cases and deaths, and while it had 18.3% of global cases through August (with only 4% of world population), that is down from a high of 25.9% in January. The proportion for August, however, was up slightly from the low of 18.0% at the end of July.

Similarly, deaths have declined from 20.9% of the world total in September to 14.5% in August, down slightly from July. As you will see in details to follow, while USA outpaced everyone through the early months of the pandemic, the vast disparity is slowly shrinking. The projection cone surrounding USA Cases in Figure 1 shows a pronounced flattening of the curve from January to July, with a very noticeable upward bend in August, though still in the bottom half of the projection cone (which for USA extends from roughly 25 to 70-million). The upward bend for USA cases in August is clearly visible in Figure 1, but even more pronounced in Figure 8 below, which "zooms in" just on USA.

Figure 1 also shows how much lower cases in the US would be—approaching 9-million by now, instead of nearly 40-million—if they were proportional to the global population. It would also mean just over 180-thousand deaths instead of 656-thousand. One must be careful, however, in stating the situation so simplistically, since reality is a complex set of factors. At the same time, it cannot be denied that the US share to date has been extraordinarily high compared to other large countries.

- Countries to watch. For this report, I moved Philippines into the list of monitored countries, increasing that list from 26 to 27 countries (a profile of this list can be found at the bottom of this page). In addition, the weekly comparison report on worldometers gives a sense of hot spots to watch. Based on activity in the last week or two, this includes Malaysia, Japan, Thailand, Vietnam, Israel and Cuba. While some of these have population too small to make much of an impact on this report, they generally confirm (along with countries recently added to my monitored list) the shift of growth in COVID from Europe and North America to Asia and South America.

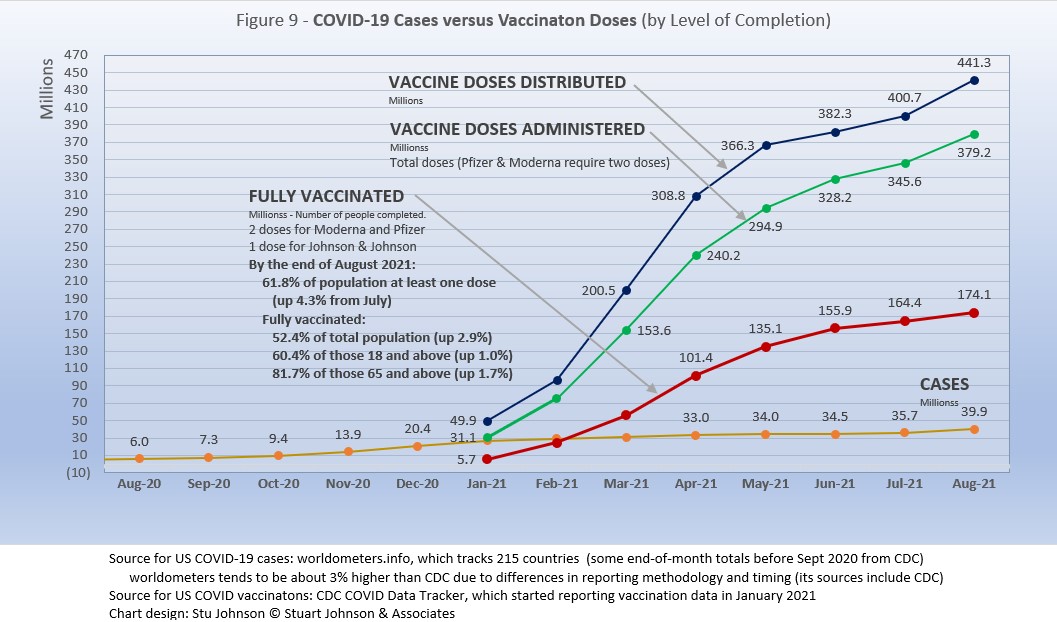

- With vaccinations, USA continues to move ahead. After a noticeable slowdown in June and July, the August numbers moved up again as the delta variant was recognized for its contribution to surges, particularly among the unvaccinated. Because two doses are required for Pfizer and Moderna, the curve for fully vaccinated increased at a smaller rate than did doses distributed and administered. (See Figure 9).

This is where I have to suggest how important it is to get information from reliable and knowledgeable sources that know how to interpret the numbers. In an atmosphere wary of misinformation, news-by-anecdote from otherwise trusted sources can itself be a form of misinformation. As I go through the statistics each month, I am reminded often that the numbers do not always line up with the impressions from the news. With that caveat, let's dig into the numbers for August 2021.

The Continental View

While COVID-19 has been classified as a global pandemic, it is not distributed evenly around the world, though we began to see some shifts in patterns starting in April 2021.

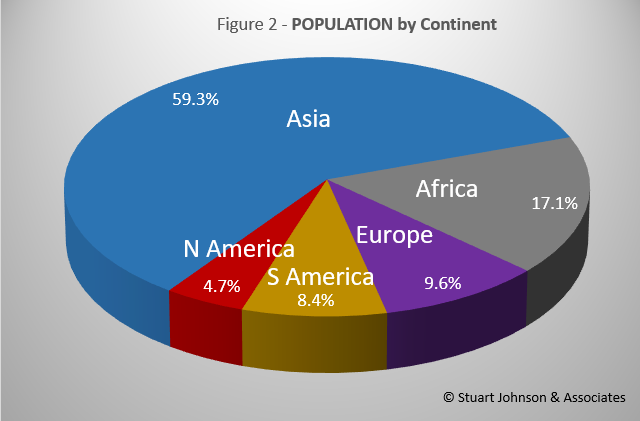

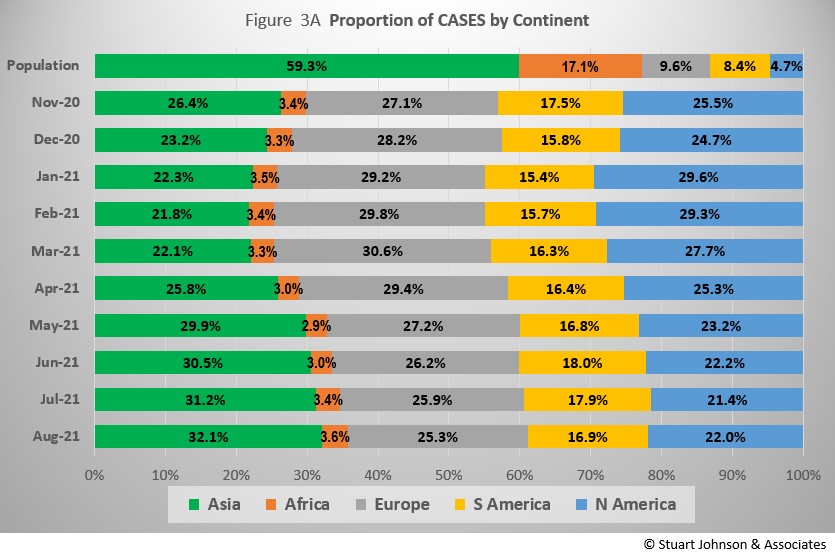

Asia accounts for 59.3% of the world's population (Figure 2), but had only 32.1% of COVID cases at the end of August (Figure 3A)—affecting a mere 1.5% of its population (COVID cases have been reported for 2.8% of world population). This is up from 1.3% for Asia and 2.5% for global population in July.

After shrinking in proportion of cases since October, Asia continues to increase, with each month since March surpassing the previous month. The trade-off is general decline in Europe and the Americas. Europe has been down each month since March. .North America also went down since March, but bumped up a bit in August. .Meanwhile South America (with 8.4% of world population) bottomed out at around 15% of COVID cases back in January and has crept up to a share of 18% in June before staring to shrink again.

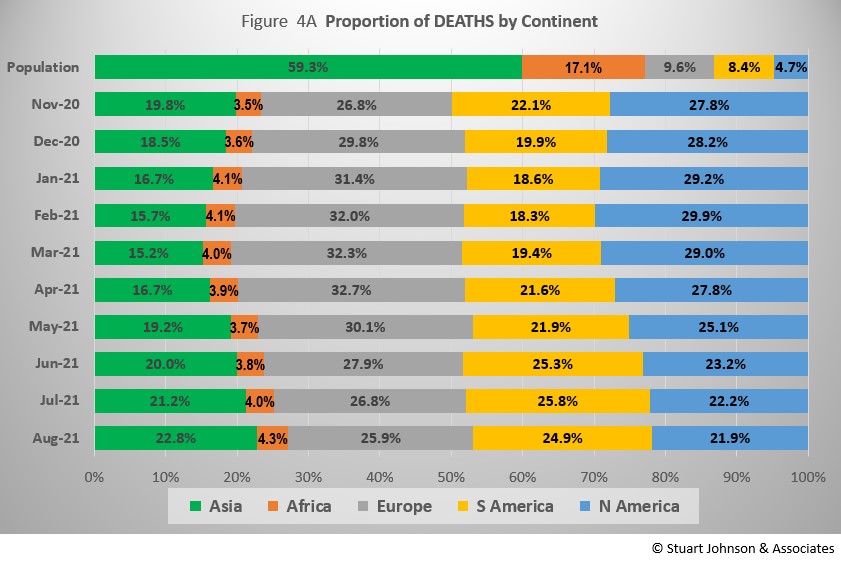

Where Asia and Africa combined represent about three-quarters (76.4%) of the world's 7.8-billion people, Europe, South America and North America still account for nearly two-thirds of cases (64.2% - Figure 3A) and about 7 in 10 of COVID deaths (72.8% - Figure 4A). The shares for Europe and the Americas combined are slowly coming down from their highs (74.7% for cases and 80.8% for deaths in February).

Oceana's population is too small to be statistically significant, so it is not included in my analysis.

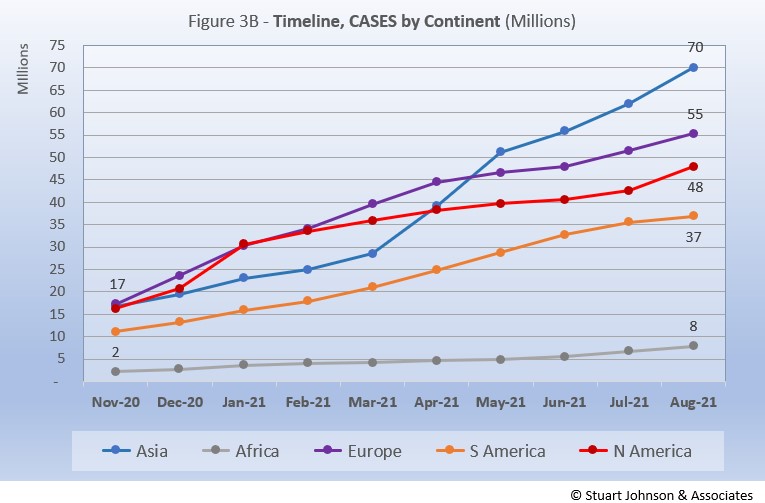

While news reports have given the impression of widespread delta-variant surges, growth in the number of cases in August was not uniform across continents. Asia and North America were up, while South America slowed. Europe and Africa continued on the same rate of increase that started last month.

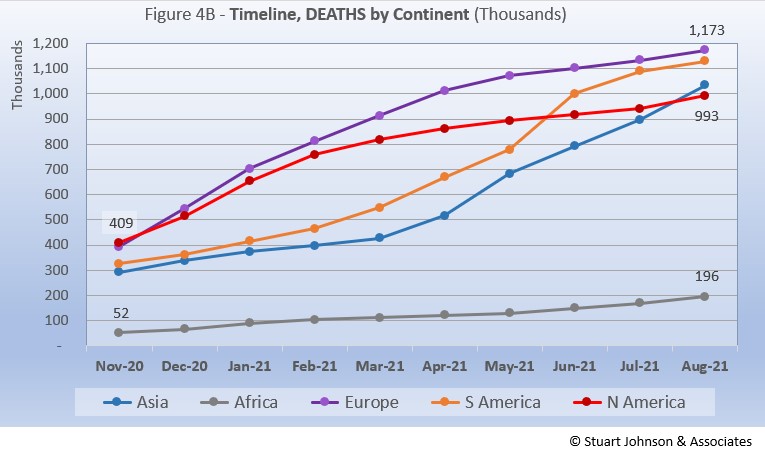

Asia has the highest number of reported COVID cases, having surpassed both Europe and North America as it experienced a dramatic upturn in April and May, slowed some in June and July, then accelerated again in August. South America remains in fourth place and slowed down in rate of growth slightly in July and even more in August.

North America began to flatten its curve back in January (when vaccinations began), dropping away from Europe in number of cases, but showed a slight upward bend in its curve in July and moved upward even more in August. Europe (slower to get vaccinations started) showed a slight increase in pace in March and April before decelerating in May and June, but it too has bent upward, but more modestly in July and August then Asia or North America. Africa, second by population, remains a loner, with an almost flat curve compared to the other four large continents, but it also bent upward in July and August.

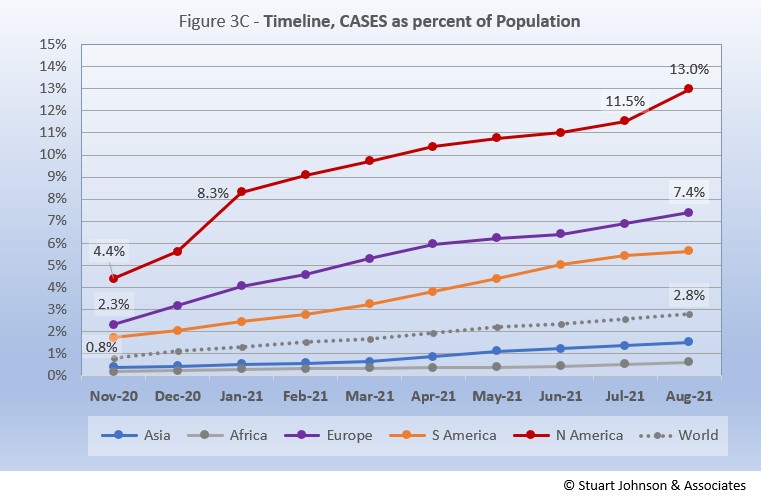

The raw numbers of Figure 3B can be deceptive. Figure 3C gives a more realistic picture of impact by translating raw case numbers to percentage of population.

After a sharp increase in January, North America slowed down for six months, before jumping 1.5 points to 13.0% in August—far ahead of the other continents in proportion of population reported with COVID and the most dramatic change for any of them in August.

Europe remains well below North America, though it did show an increase in July and August. South America is the only continent to show a slowing in growth of cases as a proportion of population. Asia and Africa have not changed dramatically in rate over the past four months and both remain below the global rate, which stood at 2.8% at the end of August. As pointed out last month, individual countries in Asia have dominated my watch list in the past few months.

The rate of increase for Asia and Africa is masked by their sheer size. Both increased at a higher rate than the global increase of 10% in cases, but the change in proportion of population was relatively small. Africa, for example, increased in number of cases for August by 16%, North America by 13%, yet Africa increased in proportion of population by only 0.1 percent (0.5% to 0.6%), while North America went from 11.5% to 13.0%, a full 1.5 percent increase. Africa's population is roughly four times larger than North America.

The proportion of deaths between continents is even more distorted than that of cases. In the early months of COVID, Europe and the Americas were growing in deaths, forcing Asia to bottom out in its proportion of global deaths at 15.2% in March. From there, Asia has increased in proportion of COVID deaths—22.8% in August—but still only about a third of its proportion of global population.

Europe, with 9.6% of world population, hit its high of 32.7% of COVID cases in April, after which it moved steadily down to 25.9% by the end of August. North America topped out at 29.9% in February and has since declined to 21.9% in August, despite a significant rise in cases. South America has been slower to adjust and it is not clear a trend exists. It bottomed out at 18.3% in February, then climbed to 25.8% in July before shrinking back to 24.9% in August.

Africa has not changed all that much in proportion of COVID deaths, ranging from 3.5% in November to 4.3% in August.

Deaths through August shows that while the trajectory lags behind cases and has progressed at a steadier rate, it does reflect the overall changes in Cases by continent. Three of the five continents (Asia, Europe and South America) are now over 1-million deaths and North America will cross that benchmark before the next report.

Europe remains at the top in number of deaths. The growth rate for South America, which climbed dramatically in June and seemed poised to pass Europe, slowed even more in August, so it remains in second place. Asia did pass the 1-million mark–and North America—moving it into third place. North America moved upward in August deaths, but not as fast as cases, which allowed Asia to claim third place. Africa continues at a slow and steady pace, well below the other continents despite it being second in size, with 1.3-billion people.

Comparison of U.S. with other Countries

Cases

Raw numbers are virtually meaningless without relating them to the size of a given country, so looking at cases as a proportion of population helps get a sense of the relative impact.

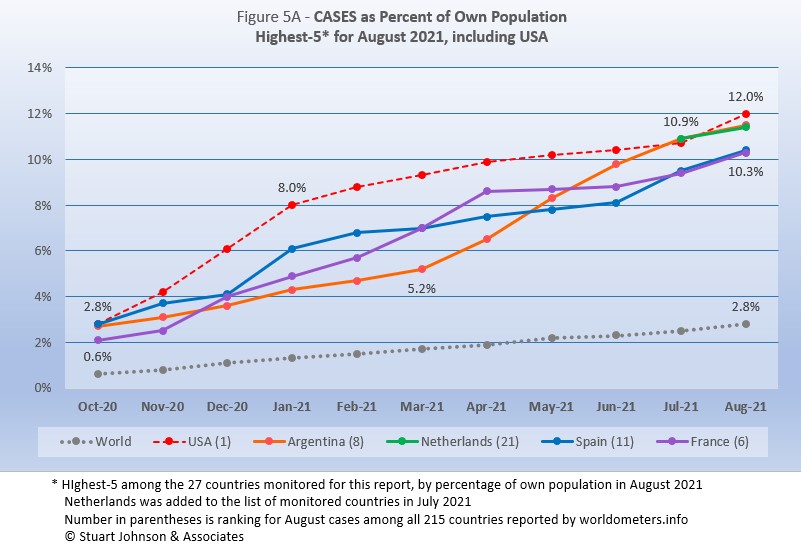

Belgium and Columbia drop from the top-5, replaced by Netherlands (new to the list of monitored countries last month) and France.

USA gains the dubious distinction of moving back into the top spot after slowing since vaccination started in January. Argentina slowed in August (about the path that USA was on) so it moved back to number 2. Netherlands hits the chart in third place, but in a virtual tie with Argentina, only 0.1% behind. Spain (4) and France (5), which have been swapping places over past months, also ended in a near tie from July to August, also separated by only 0.1%.

The top-5 by proportion of population with COVID cases, have progressed at a rate higher than the Global level, but have stayed within a fairly narrow band that has been tightening since March.

Another way to look at population proportion is the measure "1 in." The global figure of 2.8% means that 1 in 36 people in the world have been reported with COVID (and that only by official record keeping, not including any unreported and likely asymptomatic cases). For USA it is 1 in

8. For Spain and Columbia it is 1 in 11.

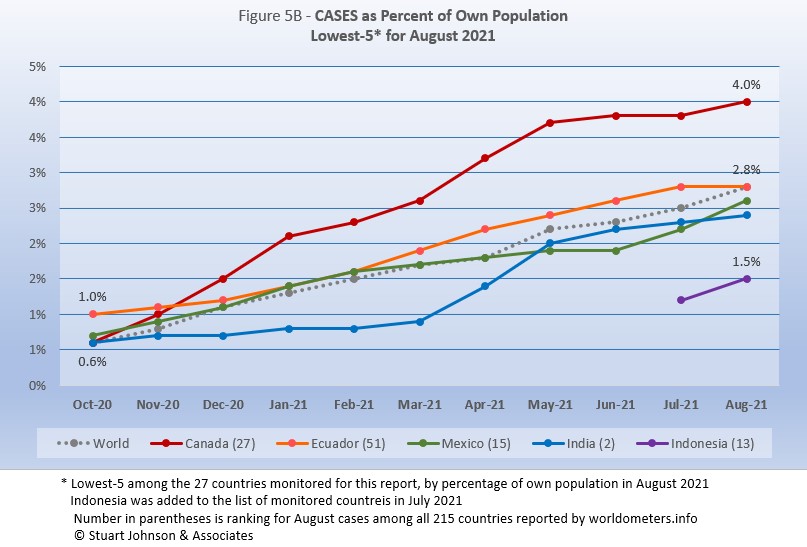

Bolivia dropped from the chart this month, replaced by Indonesia, which was added to the list of monitored countries in July.

At the low end (Fig. 5B), the five lowest countries for cases by proportion of population are much closer to the global figure of 2.8% of population with confirmed cases of COVID-19 at the end of August, with Canada and Indonesia the outliers.

Canada remains well above the global level, Indonesia below it. The other three have been close to the global level since May. Ecuador and Mexico were very close to each other from October to February when they began to separate a bit, yet remain close to the global level. India started at the global level in October, stayed level for the next five months, then caught up with the global level in May and has been closer to Ecuador and Mexico since then.

These countries represent a considerable spread in size, from India, the second largest country, to Ecuador, ranked number 67 of the 215 countries tracked by worldometers. For Canada, its 4.0% level represents 1 in 25 people, for India it is 1 in 42 and for Indonesia it is 1 in 67.

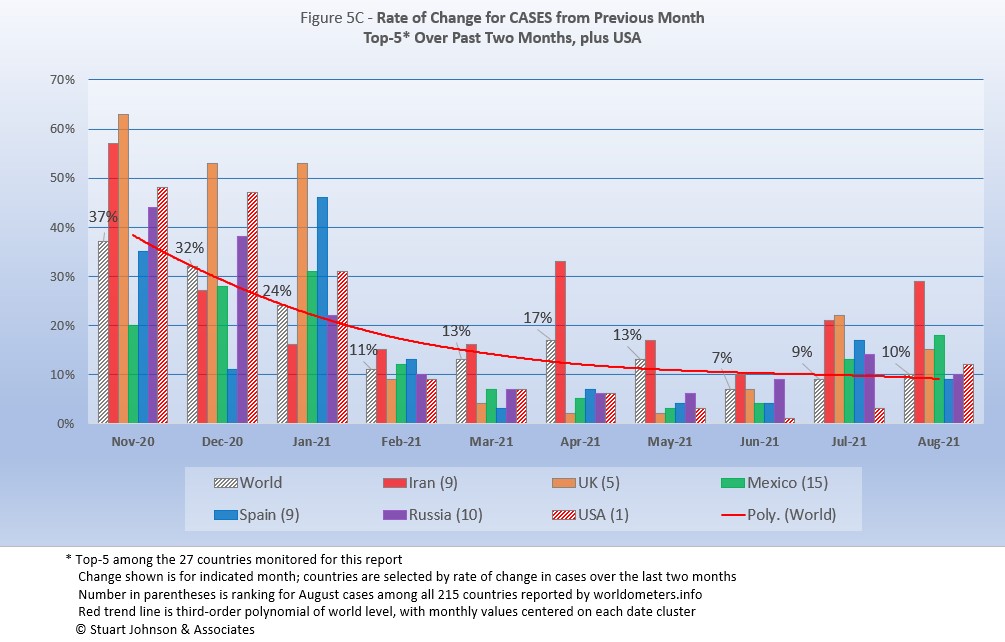

Because the size of countries makes the use of raw case numbers illusory, another measure I find helpful is the rate of change from month to month (Figure 5C). The focus of the selection is on recent changes, but the chart goes back to November to keep the surges of late 2020 in perspective.

For this chart, countries are selected based on the change over two-months (end of June to end of August for this report). Except for USA (which will appear every month), the mix has changed and shifted away from South America (a trend noted in the Continental View above). Iran and UK continue, but Mexico, Spain and Russia replace Colombia, Argentina, and Bolivia.

The overall trend (red line, reflecting global level) flattens as it drops, though the Global level itself is up slightly from its low of 7% in June. (A polynomial trend line flexes as adjacent data points go up and down, so the leading edge of newest dates can change the shape of the curve as new months are added). Note also that some months appear "flatter" than others, with less variation between countries and the global (world) number.

Overall, global levels were much higher from November through January (the highest period of surging cases as pointed out in Figure 1), as was the absolute variation between countries.

Iran has experienced month-to-month increases of 29% in July and 21% in August, but had a high of 57% in November. UK, after doing well with its plans to "reopen" got caught with delta-variant surges, turning very low monthly increases from March through June into 22% and 15% increases of cases in July and August. Mexico, Spain and Russia showed similar patterns, with below-global levels from March through June, then Mexico was above the global level in both July and August, while Spain and Russia were higher in July but close to the global level in August.

USA started well above the Global level from November (48%) through January (31%), then dropped to 9% in February after vaccinations had begun and the surge seemed to have ended (in USA anyway). From there it is fell further below the global level each month until reaching a low of 1% in June. This has reversed, with a small bump in July that was still well below the global level. Then August went above the global rate (10%) to hit a 12% increase, not as bad as the early surge, but enough to show the impact of delta on the still-too-large number of unvaccinated individuals. (This is visible in Figure 1, which compares Global and USA curves, but even more evident in Figure 8, which focuses on USA),

Deaths

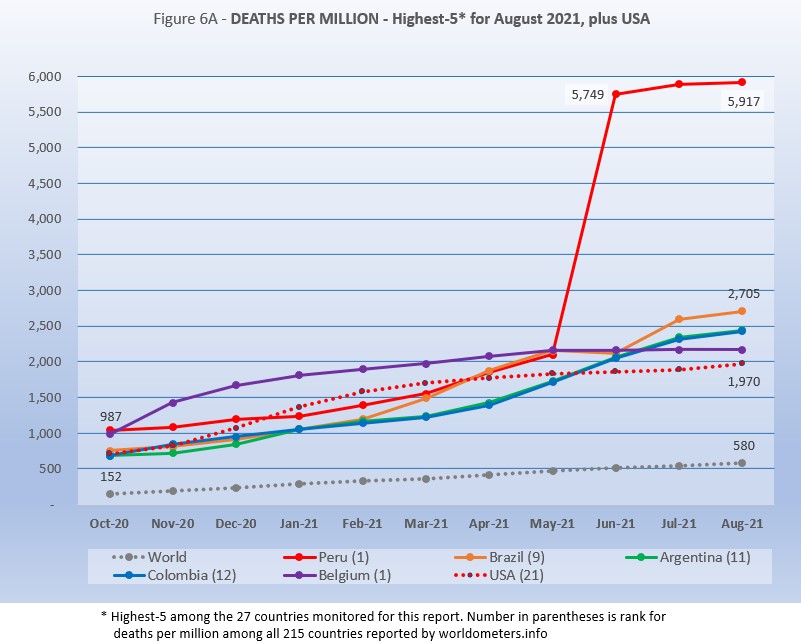

Because deaths as a percentage of population is such a small number, the "Deaths-per-Million" metric shown in Figure 6A provides a comparable measure.

Peru and Brazil stay at #1 and #2 from July. Argentina and Columbia swap the #3 and #4 positions, while Belgium stays at #5. Despite the reduced impact of South America in rising case numbers, this keeps the same four countries in South America in the top-five for Deaths-per-Million in July.

As Figure 6A shows, Peru still soars over the others following a correction to its death data in June. August remains more than double #2 Brazil and ten times the Global level of 543.

The other South American countries have all been moving upward in deaths-per-million. In fact, Columbia and Argentina are so close, you can barely tell them apart on the chart. Belgium has been slowing down in monthly deaths-per-million, but remains in the top-five of the 27 countries I monitor.

Since this analysis focuses on 27 countries that have been in the top-20 of cases and deaths, there are 7 other countries with Deaths-per-Million between Peru and Brazil. The second place country at the end of August (as it was in July) was Hungary (population 9.6-million) with a Deaths-per-Million of 3,121. Ranked #6 was Czechia (population 10.7-million) at 2,833. Ranked #7 was Bulgaria (population 6.8-million) at 2,759.

The other countries on the chart, including USA are all above the Global level, and (except for Peru) fairly close to each other—though in August they continued to spread out from their closest proximity in June.

The overall trend shown in Figure 6A is that USA, with aggressive testing and vaccination, had seen slowing COVID deaths since January, while Europe (represented by Belgium) was also beginning to slow deaths in recent months. While the delta variant is causing cases to rise, death rates in general remain unaffected or low in comparison—the exception being South America, where death rates remain high.

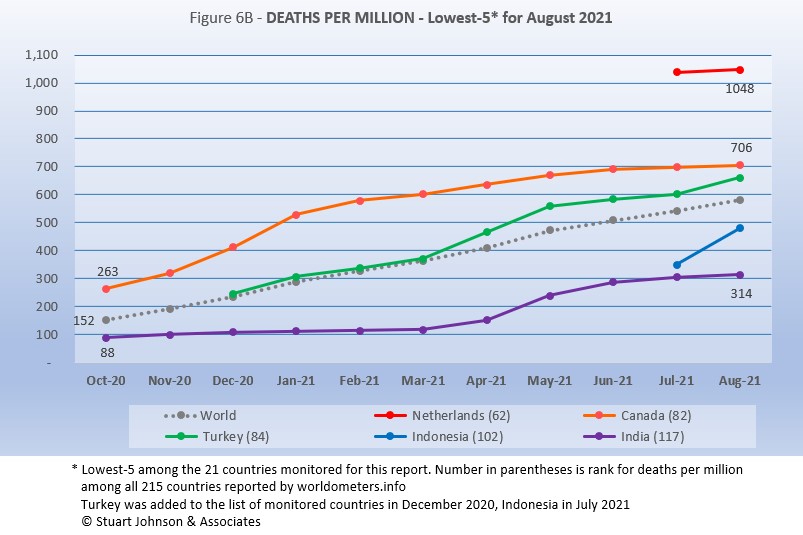

Among the lowest five for Deaths-per-Million, Netherlands and Indonesia (added to the list of monitored countries last month) hit the chart this month, replacing Russia and Iran. Canada, Turkey and India remain in the same order as they have since at least October of 2020.

Canada, similar to USA, has slowed considerably since vaccinations became available in January but remains above the Global level. Turkey, also above the Global level, is rising at a rate slightly above the increase in the Global rate. India, which has been below the Global level each month, began to rise in April, then has leveled off more since June. Indonesia shows a sharp increase, but its curve represents only two months, so we will watch its curve develop in future months.

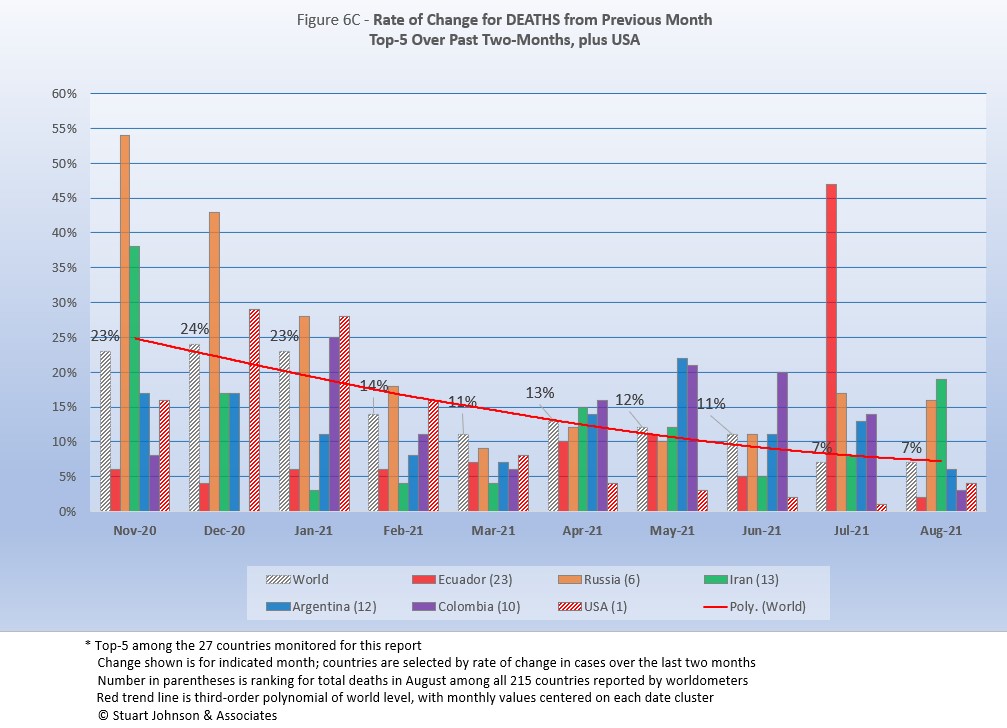

As with the comparable chart for Rate of Change for Cases (Figure 5C), countries for Rate of Change for Deaths (Figure 6C) are selected based on the change over two-months (end of June to end of August for this report) in reported COVID deaths. The focus of the selection is on recent changes, but the chart goes back to November to keep the surges of late 2020 in perspective.

Except for USA (which will appear every month), the mix has changed since the last report. Peru, which had an extraordinary adjustment of data in June, has dropped off this chart, replaced by Iran. Ecuador moves up one place to #1, Russia is up three places to #2. Iran comes in at #3, Argentina stays at #4 and Colombia moves down two places to #5.

The trend

in the rate of change in deaths (red line in Figure 6C) shows the delayed connection with cases and appears smoother than the month-to-month changes in the Global level. Monthly Global changes for deaths trended down through May, bumped up in April, then went back down in May and continued going down to 7% in both July and August. As we saw with Peru last month, the large increase for Ecuador in July was not enough to bend the global trend. (As mentioned with Rate of Change for Cases, the trend line is a polynomial that can change shape as new values are added at the most-recent end.)

An important comparison is individual countries each month against the global (World) level. As shown in Figure 6C, the Global level peaked at 24% in December, with Russia at or above the Global level from November through February. As the Global level dropped, so did the variance of change in the top-5 countries included in this month's chart—until April, that is, when three of the five were above the Global level. In the past two months (the basis for selection in this chart), Ecuador soared above the rest with the 47% increase for July over June. In August that settled down to only 2%, well below the Global level (some variations of this magnitude can be due to anomalies in reporting, so we have to be careful in making inferences from a single month unless a specific circumstance is known, such as Peru's correction of death numbers in June). Russia reported increases of 17% and 18% for July and August, well above the Global rate of 7% each of those months. Iran was about even with the Global level in July, but a change of 19% in August combined to put it in the top-5 this month. Argentina and Colombia both dropped below the Global level in August but July was high enough for both, so their two-month change kept them in the top-5.

USA was higher than the Global level in December, January and February, then has been significantly lower since then, falling to a 1% change in July (over the number of deaths in June), but that bumped up in August to 4% over July, still well below the Global level of 7%.

Mortality Rates (percentage of deaths against reported cases) have generally been slowly declining. This is not surprising as several factors came into play:

- In the early days of the pandemic, there was a high proportion of "outbreak" cases (nursing homes, retirement communities, other settings with a concentration of more vulnerable people). As the pandemic continued the ratio of "community spread" (with lower death rates) to "outbreaks" increased and the overall Mortality Rate went down.

- As knowledge about treatment increased, mortality went down.

- Since the death count is more certain (though not without inaccuracies), the side of the side of the equation that could change the most was cases. As testing revealed more cases, the Morality Rate would naturally go down. In addition, the official numbers do not take into account a potentially higher number of people with the virus who are asymptomatic, so the real mortality rate could be even lower.

- Vaccinations started in January (though that should impact both cases and deaths).

The situation with the delta variant now is producing surges in cases, particularly among those who are unvaccinated, though the death rate may be lower than early on, which will result in a lower mortality rate. What I find most troubling about the delta surges in USA is how unnecessary they are, with roughly 95% of those hospitalized being unvaccinated. No wonder more voices among health care workers have little room for empathy, expressing instead frustration and anger. I share that sense of anger, when people acting out of selfish and misguided motives make things far worse than they should be.

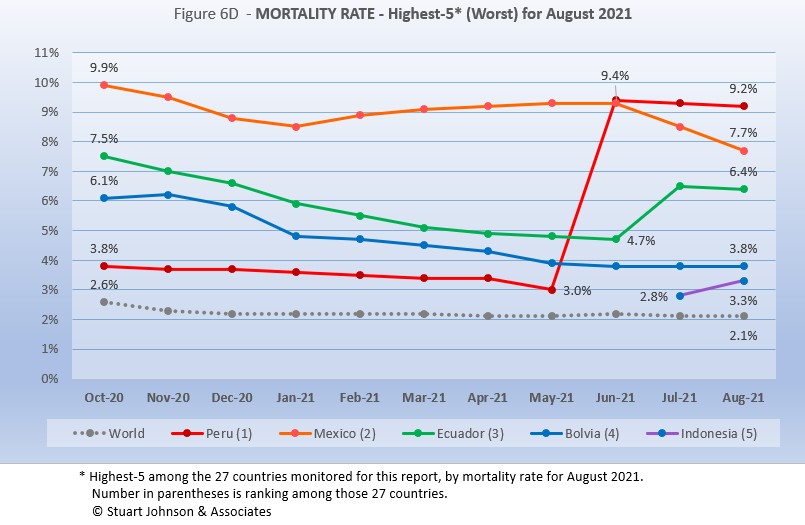

The Global mortality rate has dropped from 2.6% in October to 2.1% by April, where it has stayed except for a bump back to 2.2% in June. The median for the 27 countries monitored for this report has dropped from 4.5% in October to 2.7% in March, where it remains.

Four of the top-5 in mortality rate (among the 27 countries monitored) return from July, in the same order. Indonesia, added to my list of monitored countries last month, replaces Italy at #5. Three of the five, not surprisingly, are in South America, along with nearby Mexico (all Central American countries are North America by continent).

Peru was in fourth place and declining until June when its corrected death numbers drove Mortality to 9.4%, just ahead of Mexico at 9.3%. At the end of August, Peru eased back slightly, down to 9.2% and Mexico made a significant drop to 8.5% in July and 7.7% in August. Like Peru, Ecuador had been declining faster than the Global level, but then shot up nearly two full points to 6.5% at the end of July as deaths increased 47%. That came down slightly in August to a mortality rate of 6.4%.

Bolivia's Mortality Rate has been declining, slowing down since January, but still significantly above the Global level, at 3.8% for July. Indonesia appears for the first time, showing an increase from 2.8% in July to 3.3% in August, but we will have to watch over future months to see if that levels off or continues to rise at such a significant rate.

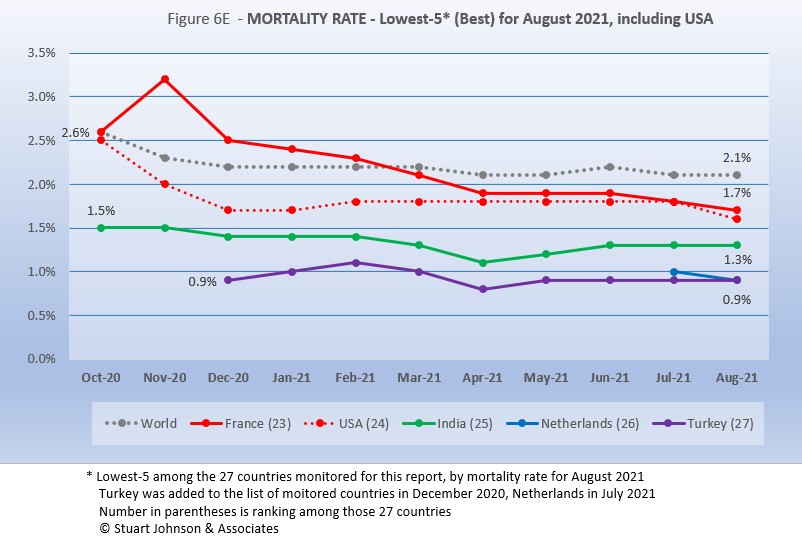

Since these represent the best mortality rates, where low is good, the "rank" order is actually in reverse. France moves "up" to #1, followed by USA and India. Netherlands, #4, replaces Spain, and Turkey remains at #5.

The four continuing countries have been below the Global Mortality Rate since April. France and USA have tracked closely since then, down to 1.7% and 1.6% respectively at the end of August. India hit a low of 1.1% in April, and while it increased to 1.3% since May, that is below where it was in October and November at 1.5%. Turkey has followed a similar pattern, below India, ending August at 0.9%, well below the Global level of 2.1%. Netherlands, added to the monitored list last month, ended August at the same 0.9% level as Turkey.

How real is the threat of death from COVID? That's where successful mitigation comes in. Worldwide, by the end of August, 1 in 36 people have been reported as having contracted COVID and 1 in 1,727 people have died. In USA, while the mortality rate is low, because the number of cases is so high, 1 in 508 have died through August 2021. UK, Chile and Ecuador are slightly higher, Poland, Mexico and Italy are slightly lower.

With low mortality, USA should have been able to keep deaths much lower, but the extraordinarily high number of cases means more deaths. Without a better-than-global mortality rate, the USA death rate would be far higher. Compared to the 1918 pandemic, it could be ten times worse. At the Global mortality rate of 2.1%, USA would have had 838-thousand deaths (for 39.9-million cases) by the end of August, instead of 656-thousand. The response of the health care system and availability of vaccines are part of keeping mortality down, but it's far too early to detail the cause for that positive piece of the COVID picture for USA.

Tests

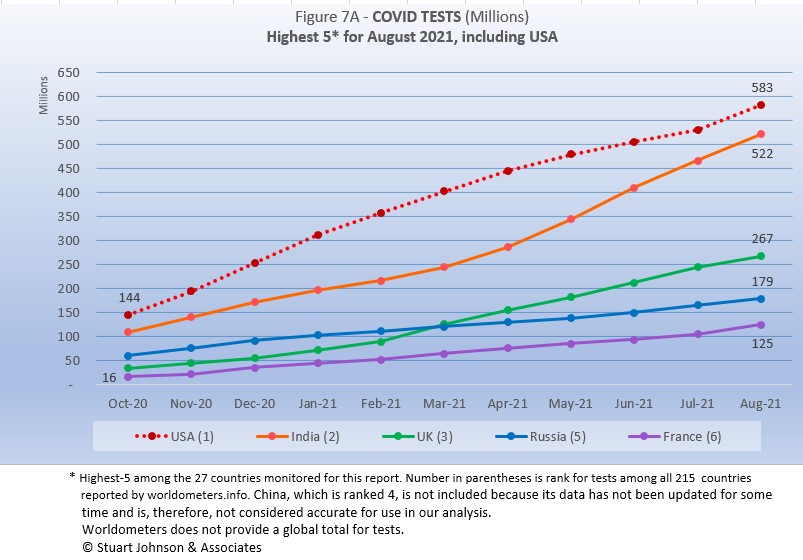

The same five countries remain on top in COVID testings, having been in the same order since October 2020.

USA remains ahead of other countries in reported COVID tests administered, at 583-million, 11% ahead of India, but that has narrowed from 56% in April. UK continues at the pace it set with an upturn in February, having moved past Russia in March. Russia and France continue on a steady upward path, roughly 60-million tests apart since January.

These are raw numbers, so it is important to recognize the size of the country. It is also the case that COVID tests can be administered multiple times to the same person, so it cannot be assumed that USA has tested almost all of its population of some 330-million. Some schools and organizations with in-person gatherings are testing as frequently as once a week or more for those who are not yet fully vaccinated. That's a lot of testing!

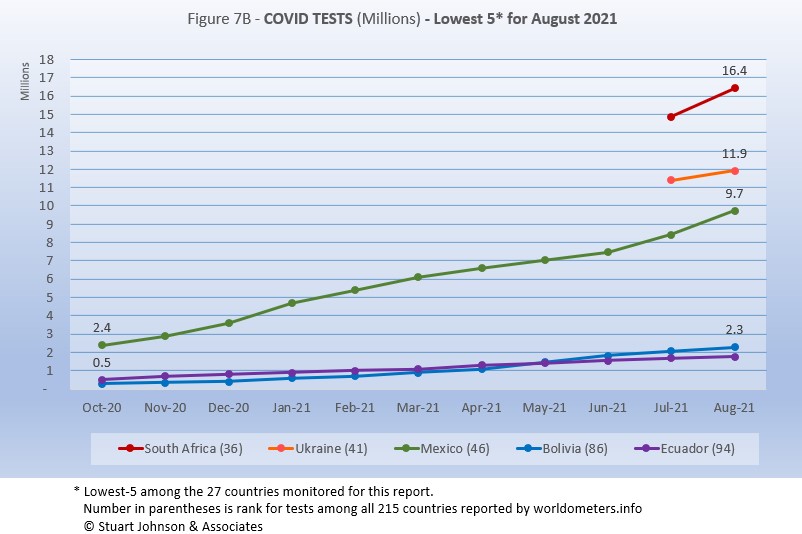

South Africa and Ukraine (both added to my monitored list last month) replace Belgium and Peru. The others return in the same order as July.

There is tremendous disparity between countries in terms of testing. All five, though still tilted toward the Americas, show the problem of low testing across Africa and parts of Eastern Europe and Asia.

South Africa shows a steep increase in testing, close to Mexico, which is encouraging, but with only two months of data, we'll have to see how it goes in coming months. Ukraine's increase is more modest, but headed in the right direction, Bolivia and Ecuador remain at the bottom of testing.

South Africa, Mexico and Bolivia all increased testing more than 10% over July. (For all 27 of the monitored countries, the increase was 9%). Ukraine and Ecuador increase by only 5% over July.

As questions arise about equity of testing between countries, check the number of tests for countries of similar size (within the 27 monitored countries):

- Mexico: 9.7M tests for 129.3M population, compared to Philippines: 18.7M tests for 109.6M population (2X the tests)

- South Africa: 16.4M tests for 59.3M population compared to Italy: 83.7M tests for 60.4M population (5X)

- Ukraine: 12.0M tests for 43.7M population, compared to Argentina: 22.0M tests for 45.2M population (2X)

- Ecuador: 1.8M tests for 17.6M population, compared to Netherlands: 16.6M tests for 17.1M population (9X)

- Bolivia: 2.3M tests for 11.7M population, compared to Belgium: 18.6M tests for 11.6M population (8X)

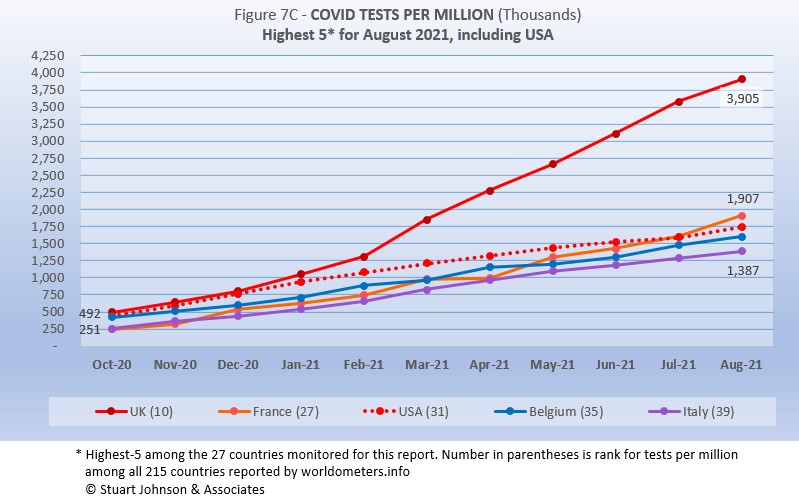

Tests per million adds another perspective. Fig. 7C shows the five countries with the highest tests per million. All five return from July,in the same order (though they appear tied, France was ahead of USA in July).

The UK, already the most aggressive in testing, increased its numeric lead each month since February, with a reported 3.9-million tests-per-million population in August, nearly 4 tests per person. France barely edged ahead of USA last month, but increased its pace in August, ending at 1.9-million tests-per-million, approaching two tests per person. USA continues on a straight line trajectory, with a very slight dip in June and July, followed by a slight increase in August, reaching 1.7-million tests-per-million. Belgium and Italy are not far behind, tracking closely with France and USA. Italy is up to 1.4-million tests-per-million, approach 1.5 tests per person.

Anything over 1,000 (or "x-million tests-per-million") represents more tests than people (1,000 on the chart actually means 1,000,000), but as mentioned above, that does not mean that everyone had been tested. Some people have been tested more than once, and some are being tested regularly or with increased frequency.

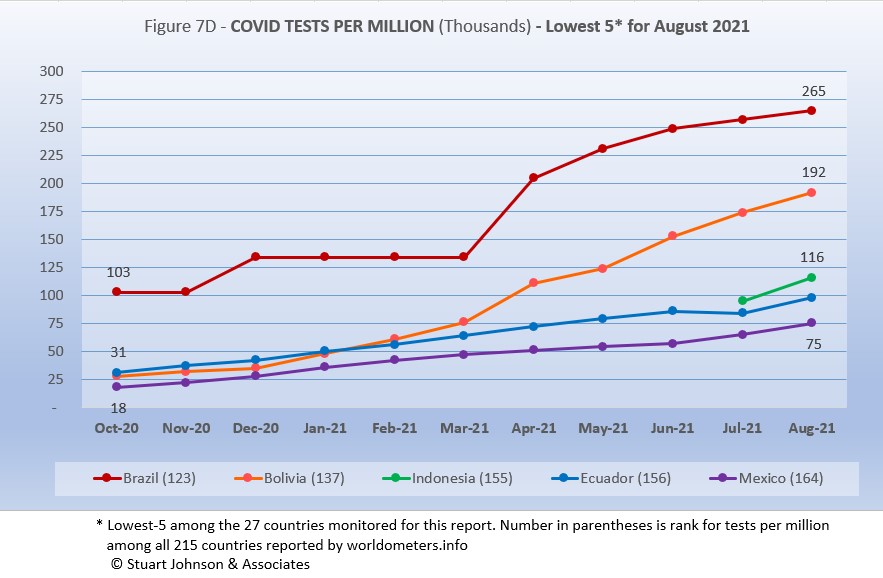

Indonesia, added to the list of monitored countries last month, moves onto the chart at #3, replacing Iran. That moves Brazil and Bolivia to #1 and #2. Ecuador and Mexico remain at #4 and #5, where they have been since February.

While still at the bottom of the 27 countries monitored for this report, Brazil and Bolivia have made the most substantial progress, Brazil with possible inconsistencies in reporting through March, than steady progress to 265-thousand tests-per-million in August—enough to cover about a quarter of the population. Boliva has been steadily moving up, hitting 192-thousand tests-per-million. Indonesia, Ecuador, and Mexico all are at or below enough tests for a tenth of their populations.

While improvement is evident in all five, the equivalent proportion of tests to population remains very low, from roughly 7% to 27% (and that would be reduced in some individuals receive more than one test). This illustrates the arguments over inequity in resources among countries.

Causes of Death in U.S.

Early in the reporting on COVID, as the death rate climbed in the U.S., a great deal of attention was given to benchmarks, most notably as it approached 58,000, matching the number of American military deaths in the Vietnam War. At that time, I wrote the first article in this series, "About Those Numbers," in which I looked at ways of viewing the data, which at the time of that writing in May 2020 was still focused on worst-case models and familiar benchmarks, like Vietnam.

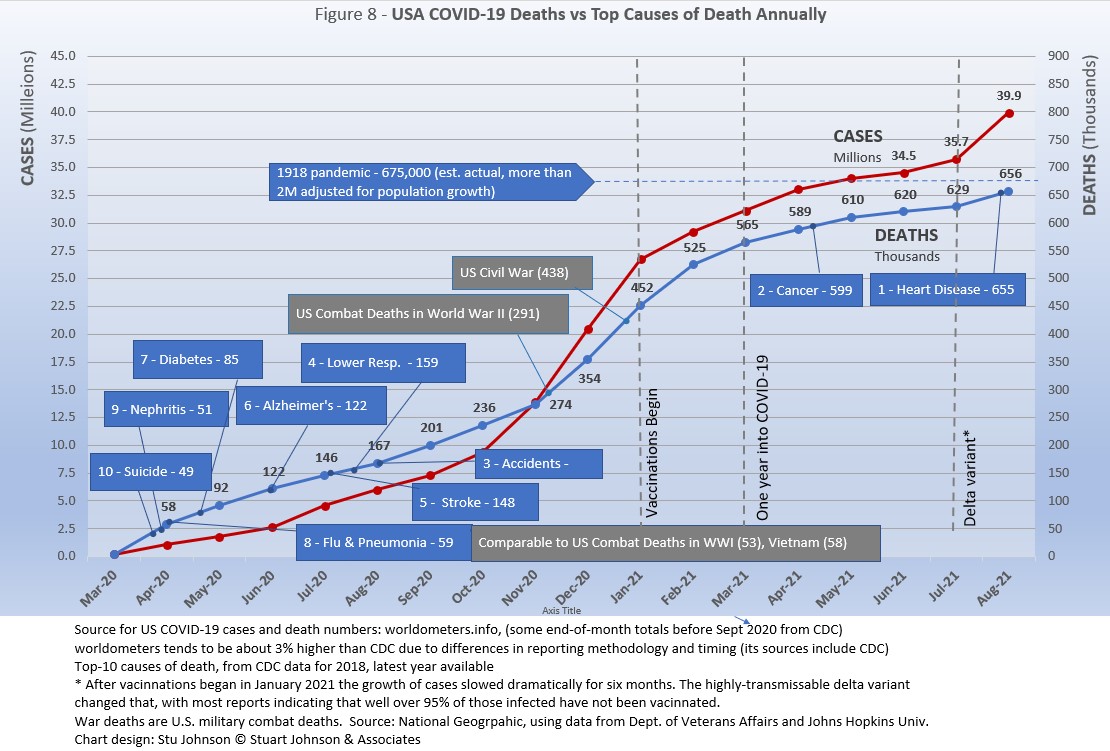

Figure 8 shows the number of US COVID cases and deaths against the top-10 causes of death reported by CDC for 2018 (the latest data available), along with several other mileposts from wars and the 1918 pandemic. Notice that for nearly nine months, the curve for deaths was increasing at a faster rate than cases. Then, starting in October 2020 the curve for cases took a decided turn upward, while deaths increased at a more moderate pace (the two curves use different scales, but reflects the relative rate of growth between them).

Most media sources reported that the U.S. would pass 500,000 deaths on February 22, 2021. The CDC reported 497,415 deaths on February 21, while worldometer.info was already reporting 512,068. As mentioned elsewhere in this report, worldometer tends to be about 3% ahead of CDC and Johns Hopkins, a matter of a few days difference in data collection. At any rate, it is clear that February 2020 saw the U.S. death toll from COVID pass the 500,000 mark, headed toward 600,000.

The February slowdown in cases was met by a barely perceptible slowdown in deaths, because as pointed out earlier, deaths trail changes in cases. That trend continued in March and bent downward even more in April. In fact, if the trajectory from November to February had continued (the upper edge of the blue cone), we would have seen close to 1-million deaths by the end of July. The total of 610-thousand at the end of May did pass the number who died from Cancer in 2018 (599,000).

The last benchmark on the top-10 causes of death is #1, heart disease, at 655-thousand in 2018. According to Worldometers.info, which I use, we just crossed that in August. CDC and other sources could have been slightly lower, but will cross it this month.

The latest "Ensemble Forecast" from CDC suggests this for the immediate future (clearing crossing the heart disease benchmark):

...the number of newly reported COVID-19 deaths will likely increase over the next 4 weeks, with 5,800 to 18,600 new deaths likely reported in the week ending September 25, 2021. The national ensemble predicts that a total of 666,000 to 697,000 COVID-19 deaths will be reported by this date...

Note: As I've referenced in the notes for several charts, the data from worldometers.info tends to be ahead of CDC and Johns Hopkins by about 3%, because of reporting methodology and timing. I use it as a primary source because its main table is very easy to sort and provides the relevant data for these reports.

Perspective

The 1918-19 Spanish Flu pandemic is estimated to have struck 500 million people, 26.3% of the world population of 1.9-billion at that time. By contrast, we're now at 2.8% of the global population. Deaths a century ago have been widely estimated at between 50- and 100-million worldwide, putting the global mortality rate somewhere between 10 and 20-percent. It has been estimated that 675,000 died in the U.S.

IF COVID-19 hit at the same rate as 1918, we would see about 2-billion cases worldwide by the time COVID-19 is over, with the global population now at 7.8-billion—four times what it was in 1918. There would be 200- to 400-million deaths. The U.S. is estimated to have had 27-million cases (one-quarter of the population of 108-million) and 675,000 deaths. Today, with a population of 330-million (a three-fold increase from 1918) this would mean more than 80-million cases, and 2- to 4-million deaths.

However, at the present rate of confirmed cases and mortality while the total number of global cases could approach 500 million or more—comparable to 1918 in number, that would be one-quarter of 1918 when taking population growth into account . .. and assuming the pandemic persists as long as the Spanish Flu, which went on in three waves over a two year period. At the present rate of increase (nearly 13-million cases per month) it would take another 22 months to reach 500-million, roughly June of 2023.

If the total number of cases globally did approach 500-million, using the global mortality rate of 2.1% in August, there would be roughly 10.5-million deaths worldwide, tragic but far below the number reported for 1918 (50-million) with an even wider gap (200 million) when taking population growth into account.

In my last report, I indicated that with vaccination in progress and expected to be completed in the U.S. by the end of summer, the end of COVID-19 could come sooner. Like 1918, however, there are now complicating factors, such as the combination of the delta variant with a high number of unvaccianted (some by choice, as in USA and Europe, and many more in underdeveloped countries by inequitable access to vaccine). While we may have thought the end of the pandemic was in sight, it is still too early to make predictions on the duration and severity of the COVID-19 pandemic globally.

Despite the darkening forecast in the past two months, the vast difference in scale between the Spanish Flu pandemic a century ago and COVID-19 even a year-and-a-half in, cannot be denied.. Key differences are the mitigation efforts, treatments available today (though still leaving the health care system overwhelmed in some areas during surges), and the availability of vaccines. In addition, in 1918 much of the world was focused on a brutal war among nations (World War I) rather than waging a war against the pandemic, which ran its course and was undoubtedly made much worse by the war, with trans-national troop movements, the close quarters of trench warfare, and large public gatherings supporting or protesting the war.

Vaccinations in the U.S.

With remarkable speed (it usually takes years to develop vaccines), two COVID vaccines were granted emergency approval for use in the U.S. starting in January—the one by Pfizer requires super-cold storage, which limits its deployment. The other, by Moderna, requires cold storage similar to other vaccines. Both of these require two doses, which means that vaccine dosages available must be divided in two to determine the number of people covered. By my March report, Johnson & Johnson had been granted approval for a single-dose vaccine. The numbers in Figure 9 represent the status of all three vaccines as of August 31.

A person is considered "fully vaccinated" two weeks after the final (or only) vaccine dose; roughly five to six weeks total for Pfizer and Moderna and two weeks for Johnson & Johnson.

Early on (still somewhat evident in March 2021) there was much anxiety about vaccine availability and scheduling appointments. That is behind us and vaccinations are readily available to most of the population (there will always be some disparities and trouble spots, but in general most people who want the vaccine can get it). Now, the biggest concern is convincing the dubious, the deniers, and the resisters to get vaccinated and help the country reach herd immunity (about 70% of the population fully vaccinated). Some of the latest strategies to encourage vaccination is the provision of incentives, from free beer to lotteries for the fully vaccinated, and celebrity testimonials urging vaccination. The seriousness of the delta variant has scared others into taking action.

Figure 9 shows an upturn in Doses Distributed and Administered in August, a sign that perhaps the delta variant has provided the impetus for increased vaccinations. Because of the delay between first and second doses, we should not expect to see the Fully Vaccinated curve bend up until next month.

The CDC (Centers for Disease Control and Prevention) recently revised its mask guidelines. Some resistors claim this proves the science cannot be trusted—but that position misunderstands the nature and role of science, which is to observe and constantly assess assumptions and recommendations based on a growing (and developing) body of data.

Some school districts that were prepared to make masking optional announced that the school year would begin with masks in place, regardless of vaccination status. The district in which we live had strong arguments on both sides (option versus mandate) through the summer, but just before the start of school, Illinois Governor Priztker announced a mask mandate for all private and public schools pre-school through grade 12.

Debates over masking policy provides evidence that the real battle now is vaccination. A year ago we were debating lock-downs. Today the debate is how to open but remain safe. Will the rise of infections and the call for more masking be enough to spur more vaccinations? For some, perhaps, but whether low levels of vaccinations prolonged the pandemic (around the world) will be the subject of discussion and debate for years to come.

Vaccinating over 300 million people in the United States (much less a majority of the billions around the world) is a daunting task. It is a huge logistical challenge, from manufacture to distribution to administration. Yet, it remains amazing that any of this is possible this soon after the identification of the virus just over a year and a half ago.

There is a delicate balance between maintaining hope with the reality that this is a huge and complicated logistical operation that will take time, with the prospect that COVID will be with us for some time, partly because getting shots into the arms of the unvaccinated is proving to be a far bigger challenge that most officials assumed a few months ago.

As the richer countries with access to more resources make progress, the global situation is raising issues of equity and fairness within and between countries. Even as the U.S. and other countries launch large scale vaccine distribution to a needy world community, the immensity of the need is so great that a common refrain heard now is whether this aid is too little, too late. As COVID fades into a bad memory in countries able to provide help, will the sense of urgency remain high enough to produce the results needed to end this global pandemic?

Maintaining Perspective

The following section has appeared several months and I repeat it here because there is an even greater need now to evaluate what is happening: to understand the science and its dynamic nature, to put politics in perspective and to show empathy, to truly demonstrate that we are in this together and want to get out of it as soon as possible.

In the tendency to turn everything into a binary right-wrong or agree-disagree with science or government, we ignore the need to recognize the nature of science and the fact that we are dealing with very complicated issues. So, in addition to recommending excellent sources like the Centers for Disease Control and Prevention (CDC), it is also wise to consider multiple qualified sources.

While there has been much focus placed in trusting "the science," it is important to recognize that science itself changes over time based on research and available data. In the highly volatile political atmosphere we find ourselves in (not just in the U.S., but around the world), there is a danger of not allowing the experts to change their views as their own understanding expands, or of trying to silence voices of experts whose views are out of sync with "the science" as reported by the majority of media outlets.

In an earlier report, I mentioned the Greater Barrington Declaration, currently signed by nearly 58-thousand medical & public health scientists and medical practitioners, which states "As infectious disease epidemiologists and public health scientists we have grave concerns about the damaging physical and mental health impacts of the prevailing COVID-19 policies, and recommend an approach we call Focused Protection."

For a personal perspective from a scholar and practitioner who espouses an approach similar to the Focused Protection of the Greater Harrington Declaration, see comments by Scott W. Atlas, Robert Wesson Senior Fellow at the Hoover Institution at Stanford University, in an article "Science, Politics, and COVID: Will Truth Prevail?"

Several months ago on SeniorLifestyle I posted an article by Mallory Pickett of The New Yorker, "Sweden's Pandemic Experiment," which provides a fair evaluation of the very loose protocols adopted by Sweden, essentially a variation of the "Focused Protection" approach. The "jury is still out" on this one, so judge for yourself whether Sweden hit the mark any better than the area in which you live.

UPDATE ON SWEDEN: Very little change from July. At the end of August Sweden reported 1.1-million cases of COVID, or 11.1% of its population of 10.2-million (up from 10.8% in July). There have been 14,651 deaths, for a mortality rate of 1.3%. Ranked 89 by population, Sweden was number 32 in cases and number 41 in deaths (down from 29 and 39 in July).. That would put Sweden below USA and very close to Netherlands and Argentina at the top of my cases as a proportion of population, but the mortality rate would be tied with India, near the bottom (best) among the 27 counties monitored for this report and well below the global rate of 2.2%.

How we evaluate the many approaches used to deal with COVID will determine how we prepare for and approach the next global event.

What is clear in August 2021 compared to August 2020 is that while debates rage about masking and other policies, the response to surges in countries with vaccine readily available is much more like the "focused protection" approach discussed by the sources cited here than the full lockdowns of a year ago.

My purpose in mentioning these sources is to recognize that there are multiple, sometimes dissenting, voices that should be part of the conversation. The purpose of these monthly reports remains first and foremost to present the numbers about COVID-19 in a manner that helps you understand how the pandemic is progressing and how the U.S. compares to the world—and how to gain more perspective than might be gathered from the news alone.

Profile of Monitored Continents & Countries

(Data from worldometers.info).

| Rank | Country | Population | Share of World Population |

Density People per square km |

Urban Population |

Median Age |

| WORLD | 7.82B | 100% | -- | -- | -- | |

| Top 10 Countries by Population, plus Five Major Continents See lists of countries by continent |

||||||

| - | ASIA | 4.64B | 59.3% | 150 | 51 countries | 32 |

| 1 | China | 1.44B | 18.4% | 153 | 61% | 38 |

| 2 | India | 1.38B | 17.7% | 454 | 35% | 28 |

| - | AFRICA | 1.34BM | 17.1% | 45 | 59 countries | 20 |

| - | EUROPE | 747.7M | 9.6% | 34 | 44 countries | 43 |

| - | S AMERICA | 653.8M | 8.4% | 32 | 50 countries | 31 |

| - | N AMERICA | 368.9M | 4.7% | 29 | 5 countries | 39 |

| 3 | USA | 331.5M | 4.3% | 36 | 83% | 38 |

| 4 | Indonesia** | 274.5M | 3.5% | 151 | 56% | 30 |

| 5 | Pakistan* | 220.9M | 2.8% | 287 | 35% | 23 |

| 6 | Brazil | 212.9M | 2.7% | 25 | 88% | 33 |

| 7 | Nigeria* | 206.1M | 2.6% | 226 | 52% | 18 |

| 8 | Bangladesh* | 165.2M | 2.1% | 1,265 | 39% | 28 |

| 9 | Russia | 145.9M | 1.9% | 9 | 74% | 40 |

| 10 | Mexico | 129.3M | 1.7% | 66 | 84% | 29 |

| *these countries do not appear in the details because they have not yet reached a high enough threshold to be included **Indonesia was added to the monitored list in July 2021 Other Countries included in Analysis most have been in top 20 of cases or deaths |

||||||

| Rank | Country | Population | Share of World Population |

Density People per square km |

Urban Population |

Median Age |

| 13 | Philippines | 109.6M | 1.4% | 368 | 47% | 26 |

| 17 | Turkey | 84.3M | 1.1% | 110 | 76% | 32 |

| 18 | Iran | 83.9M | 1.1% | 52 | 76% | 32 |

| 19 | Germany | 83.8M | 1.1% | 240 | 76% | 46 |

| 21 | United Kingdom | 67.9M | 0.9% | 281 | 83% | 40 |

| 22 | France | 65.3M | 0.8% | 119 | 82% | 42 |

| 23 | Italy | 60.4M | 0.8% | 206 | 69% | 47 |

| 25 | South Africa* | 59.3M | 0.8% | 94 | 67% | 28 |

| 29 | Colombia | 50.9M | 0.7% | 46 | 80% | 31 |

| 30 | Spain | 46.8M | 0.6% | 94 | 80% | 45 |

| 32 | Argentina | 45.2M | 0.6% | 17 | 93% | 32 |

| 35 | Ukraine* | 43.7M | 0.6% | 75 | 69% | 41 |

| 39 | Poland* | 37.8M | 0.5% | 124 | 60% | 42 |

| 39 | Canada | 37.7M | 0.5% | 4 | 81% | 41 |

| 43 | Peru | 32.9M | 0.4% | 26 | 79% | 31 |

| 63 | Chile | 19.1M | 0.2% | 26 | 85% | 35 |

| 67 | Ecuador | 17.6M | 0.2% | 71 | 63% | 28 |

| 69 | Netherlands* | 17.1M | 0.2% | 508 | 92% | 43 |

| 80 | Bolivia | 11.7M | 0.1% | 11 | 69% | 26 |

| 81 | Belgium | 11.6M | 0.1% | 383 | 98% | 42 |

| *Added to the monitored list in July 2021 | ||||||

Scope of This Report

What I track

From the worldometers.info website I track the following Categories:

- Total Cases • Cases per Million

- Total Deaths • Deaths per Million

- Total Tests • Tests per Million (not reported at a Continental level)

- From Cases and Deaths, I calculate the Mortality Rate

Instead of reporting Cases per Million directly, I try to put raw numbers in the perspective of several key measures. These are a different way of expressing "per Million" statistics, but it seems easier to grasp.

- Country population as a proportion of global population

- Country cases and deaths as a proportion of global cases and deaths

- Country cases as a proportion of its own population

- Cases and deaths expressed as "1 in X" number of people

Who I monitor

My analysis covers countries that have appeared in the top-10 of the worldometers categories since September 2020. This includes most of the world's largest countries as well as some that are much smaller (see the chart in the previous section).

This article was originally posted on my InfoMatters blog.

Search all articles by Stu Johnson

Stu Johnson is principal of Stuart Johnson & Associates, a communications consultancy in Wheaton, Illinois. He is publisher and editor of SeniorLifestyle, writes the InfoMatters blog on his own website and contributes articles for SeniorLifestyle. • Author bio (website*) • E-mail the author (moc.setaicossajs@uts*) • Author's website (personal or primary**)* For web-based email, you may need to copy and paste the address yourself.

** opens in a new tab or window. Close it to return here.

Posted: September 8, 2021 Accessed 697 times

![]() Go to the list of most recent Health & Wellness Articles

Go to the list of most recent Health & Wellness Articles

![]() Search Health & Wellness (You can expand the search to the entire site)

Search Health & Wellness (You can expand the search to the entire site)

![]() Go to the list of Most Recent and Most Popular Articles across the site (Home Page)

Go to the list of Most Recent and Most Popular Articles across the site (Home Page)

Loading requested view...

Loading requested view...